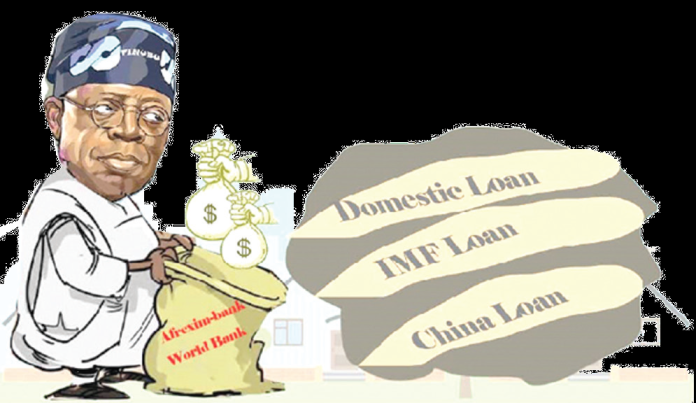

THE Senate, last Thursday through a ceremonial voice vote granted the request of President Bola Tinubu to borrow $2.2 billion (about N1.77 trillion) from external sources in a move that is now consistent with FG’s e c o nomic policy disposition of poor productivity initiatives, unrestrained profligacy and uncouth penchant for borrowing to fund pleaures. This came in the same week that the President cried to the IMF to extend more credit facilities to Nigeria as the only option left for the oil rich country to retain her children in schools. Today, Nigeria is the third most indebted nation in the world after India and Bangladesh. Maybe the point needs to be made here that the United States of America, China and Japan do also obtain facilities from the World Bank and other international credit agencies to further fund development projects to maintain their lead, in terms of infrastructure build- up and socioeconomic development.

The Senate session, presided over by Deputy Senate President, Mr Barau Jibrin was reported to have approved the loan after the Senate Committee on Local and Foreign Debts, chaired by Mr Wammako Magatarkada, presented the report of the committee. Nigeria is saddled with the reign of fiscal recklessness where loans are sought to sustain a particular spending pattern and pedigree.

The loan request, the President said, is part of a fresh external borrowing plan to partially finance the N9.7 trillion budget deficit for the 2024 fiscal year. The truly agonizing paradox is that Nigerians are currently overtaxed and Tinubu confirmed this much in July when he boasted that the FIRS and the customs had collected an all-time revenue with which to finance the budget. Why then the borrowing spree ?

Despite the essential role debt plays in enabling structural transformation and development, that is when duly applied, the rate at which Nigeria’s debt is rising under Tinubu has the tendency to constrain the country’s ability to generate sufficient growth, cope with emerging crises, and invest for development. In 2023, Nigeria’s debt reached $108.3 billion. Most of the new debt coming under the Tinubu dispensation have been externally obtained leading to an increase in the risk of the burden of becoming unsustainable.

There’s no way we can expect our local currency, the Naira to get stronger in terms of value in the exchange rate with this current debt burden. This is because global financial pressures have weakened local currencies and increased interest rates, thus increasing the cost of servicing the debt in real terms.

The high borrowing cost and rising debt is also hindering Nigeria’s ability to finance its development agenda. Increasing amounts of public revenue allocated for debt servicing purposes while critical sectors such as health and education are recording major setback. With interest payments gulping down public revenue, it has become a matter of expediency for policy makers, researchers, and committed patriots to call on the president to take practical steps to reduce the debt burden and stem the imminent crisis.

The Central Bank of Nigeria (CBN) recently said that it cost the federal government $3.58 billion to service foreign debt in the first nine months of 2024. The CBN report on international payment statistics showed that the amount represents a 39.8 per cent increase from the $2.56 billion spent during the same period in 2023.

Further breakdown of international debt figures showed that in January 2024, debt servicing costs surged by 398.9 per cent, rising to $560.52 million from $112.35 million in January 2023. February, however, saw a slight decline of 1.8 per cent, with payments reducing from $288.54 million in 2023 to $283.22 million in 2024.

The highest debt servicing payment occurred in May 2024, when $854.37 million was spent, reflecting a 286.5 per cent increase compared to $221.05 million in May 2023. June, on the other hand, saw a 6.51 per cent decline, with $50.82 million paid in 2024, down from $54.36 million in 2023. Reacting to the development in a statement, Atiku Abubakar said Nigerians are being crushed by a blend of the Tinubu administration’s “failed trial-and-error policies and loan rackets”. Abubakar said the recent report released by the World Bank identifying Nigeria as the third most indebted country to the International Development Association (IDA) “is very concerning”.

With a vision driven government in place, Nigeria has all it takes to run a debt free economy. This requires paying attention to our agricultural sector and doing all within our power to kill corruption, encourage farmers and put in place all they need, we wouldn’t have to be in debt.

Doing this would allow the government to retain enough earnings, and to invest in the empowerment of citizens, poverty alleviation, infrastructural development and the promotion of trade to boost the nation’s economy. Nigeria’s economy can be made to work again if adequate attention is paid to agriculture, manufacturing, tackling of insecurity.

Nigeria can diversify its revenue base, rely less on foreign inflows and loans, reduce the debt balance and boost domestic economic activities. The government’s efforts to generate more revenue from alternative sources should be intensified in order to prevent an unnecessary debt burden on future generations.

Investment in key sectors should be prioritized and incentives such as low interest capital should be provided to boost participation and productivity. Also, providing incentives to increase participation in agriculture should be followed by improvement in infrastructure such as roads and irrigation facilities.

There is no amount of borrowing that can register positive impact on the nation’s development for as long as we keep running a bogus profligate government system and structure. We are also most insincere with our claim to fighting corruption. The fight against corruption has been perverted into a devise for political persecution of those who are of different political persuasion.

The conundrum of food insecurity is getting more ominous by the day. We therefore need to urgently focus on sectors like agriculture and tourism, as well as empowering the teeming population of youths. It no longer makes sense to entirely depend on revenue from crude, we can diversify the nation’s revenue base, rely less on foreign inflows and loans, reduce the debt balance and boost domestic economic activities.

The sure way to start is for the federal government to demonstrate discipline as it does not make sense to ask the citizens to further tighten their belts when from all intents and purposes the government is loosening theirs largely and profoundly. Debt is not a jewel to be proudly brandished but a burden to be avoided because the borrower is slave to the lender. The earlier one is free from it, the better for the future of the country and her people.