SINCE the early 1990s when Ponzi schemes like Planwell and Money Tree hit Benin-City in Old Bendel State, with devastating impacts, the scams have continued to manifest in different forms, shapes and sizes including the MMM disingenuous fraud system that rocked Nigeria just few years ago with tales too sad to tell. These illegal financial agencies of years gone by posed as organs established to deliver investors from the pangs of poverty and suffering while robbing Peter to pay Paul, ultimately worsening their economic and social misery.

Some three years after the seeming demise of MMM, new Ponzi schemes, more than 58, have been identified across the nation, operating as illegal financial enterprises. The Economic and Financial Crimes Commission (EFCC) has listed all of them and set sight on their operations, according to the agency’s Head of Media and Publicity, Mr. Dele Oyewale, who said none of them is registered as a statutory body with either the Central Bank of Nigeria or the Security and Exchange Commission (SEC).

Legal action, he disclosed, has already been taken against some of the scam outfits, five of which had been convicted while five others have pleaded guilty, awaiting further judicial proceedings. Many more will soon be arraigned, he said. The EFCC spokesman stated that the security agency is all out to clean up the financial space of the nation and provide the investing public adequate and reliable information before they plunge into investing hard-earned funds into any opportunity offered by financial organizations.

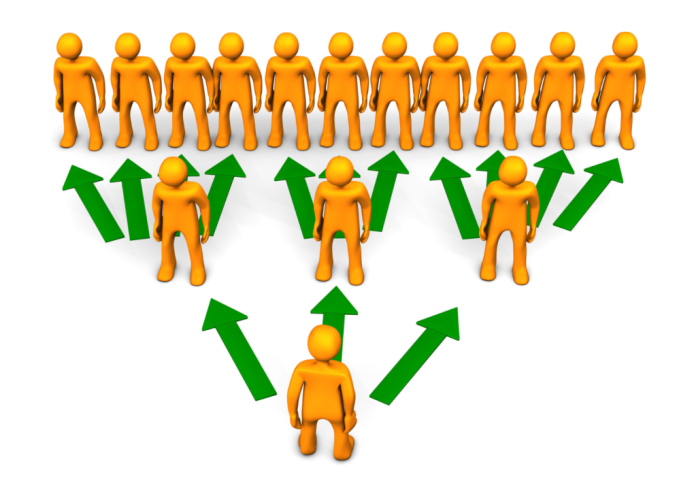

The illegal financial entities, alias Ponzi schemes, tend to exist and flourish within their short life span because they have a large pool of vulnerable clientele regardless of sad experiences they had with similar schemes in the past. As ever, the Ponzi operators create juicy baits in the form of high returns on investment and throw them at the unwary public who go for them with amazing frenzy.

Interestingly, they keep their promise by paying such huge dividends to early investors from the monetary deposits of later investors. This transaction thrives on the high rate of investors depositing their funds with the fraudulent outfits. Some investors go to the extent of borrowing to patronize the scammers. But as soon as the deposits begin to decline, the Ponzi scammers disappear with what is left of customers’ deposits, which are usually huge.

Researchers have since found that investors fall into the alluring trap of the illegal financial bodies because of greed, quest for prosperity and better life, poverty of the mind and erosion value of systems that govern wealth creation. The agonies associated with being fleeced of hard-earned money are unquantifiable. At the personal level, the victims have been known to develop different kinds of mental conditions. In extreme situations, some victims had committed suicide on account of huge sums lost.

On the other hand, the Ponzi schemes constitute big time thieves to government. As unregistered financial organs, they are not under the regulation of the appropriate government agency; they do not remit any tax to government; and once they disappear, they are difficult to trace or catch. In all, they are a menace to citizens and a huge embarrassment to government.

We appreciate the EFCC for its action so far to combat the crime posed by Ponzi scheme operators. With the alert sounded, it is imperative that the investment public should heed the warning of the anti-graft agency. This is more so when the scammers throw mouth-watering inducements at investors. Imagine the opportunity to invest one million naira to reap three million naira at the end of the month. A good number of customers buy into this and get trapped.

As already highlighted by the EFCC, investors should make proper enquiry about financial institutions before committing their finances. It is our esteemed view that a public campaign on Ponzi schemes and the associated evils be mounted by the relevant public agencies with the collaboration of the media to rescue citizens especially the youth population from the well-organized deception. Above all, citizens should cultivate and sustain the traditional virtues of hard work, diligence and creativity in their quest to get rich, as it were.